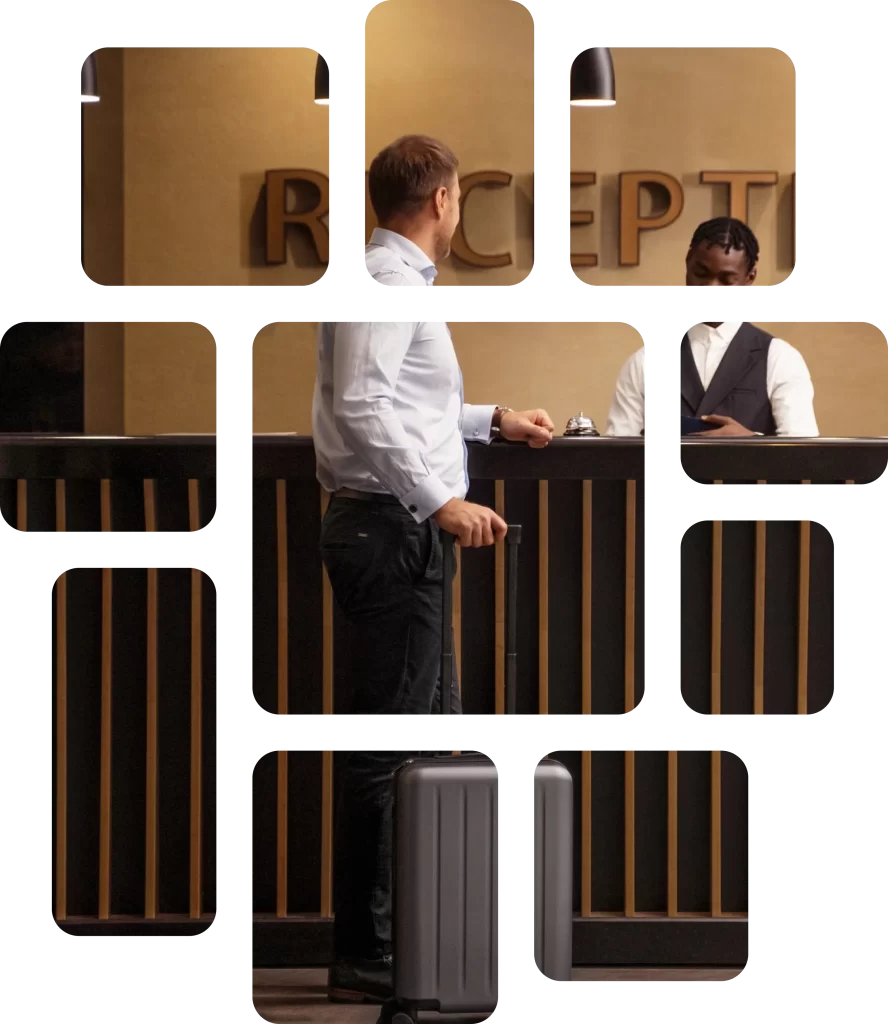

Operating a hotel or motel is a capital-intensive business that requires continuous investment to provide exceptional service and comfortable accommodations. From expanding facilities to upgrading amenities, managing a hotel or motel demands a steady flow of capital to remain competitive in the service industry.

However, obtaining traditional loans can be challenging, as lenders often perceive hotels and motels as high-risk businesses. That’s where Hotel & Motel Business Loans come in, providing the necessary financial support to address these challenges.

Explore financing options with no obligations and no impact on your credit score.

At Silver Star Financial, we are dedicated to helping hotel and motel business owners increase their revenues through tailored Business Loans for Hotels and Motels in USA.

In the hospitality industry, consistent cash flow is essential for:

We offer quick business financing solutions, including merchant cash advances and reverse consolidations, to help you meet your financial needs. Unlike traditional banks, which often consider external factors like local tourism and economic health in risk assessments, we focus on supporting your business’s growth with no-collateral business loans.

Every hotel or motel has unique financial requirements, which is why our funding solutions are tailored to meet your specific needs. With Business Loans for Hotels and Motels, you can:

Our quick and simple application process ensures you get the funds you need without unnecessary delays.

With Hotel & Motel Business Loans, you can focus on growing your business while we handle your financial needs. Contact us today to explore your options and secure the funding that aligns with your goals.

Get fast and flexible business loans, including equipment financing and merchant cash advances, to support your growth. Apply today and drive your success.